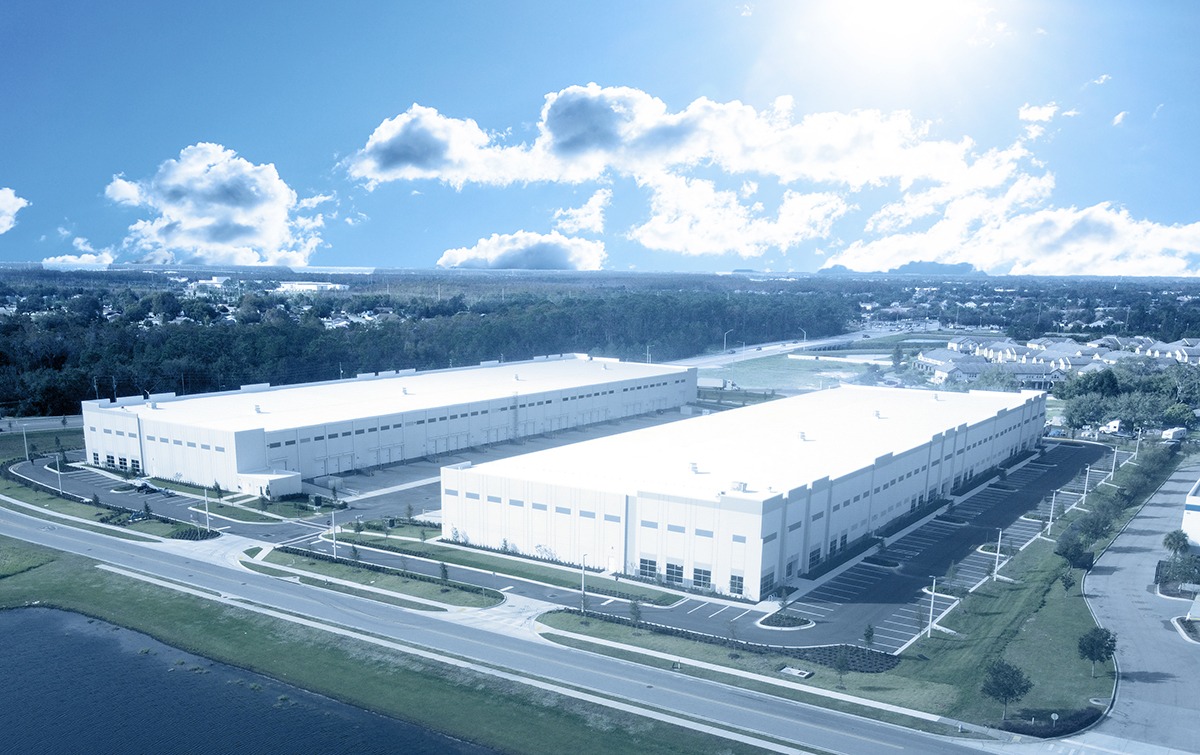

As a fully integrated, privately held real estate company, INDUS specializes in developing, acquiring, managing, and leasing best-in-class logistics properties in key U.S. distribution markets.

We own and operate a diversified portfolio designed to meet evolving supply chain demands.